The unreliability of goods and services during the pandemic revealed to consumers just how interconnected the global economy is. Whether it was computer chips or toilet paper, disruptions to the “supply chain” affected nearly everyone. The impact of global events like the war in Ukraine and the pandemic has also had an impact on energy markets, both in the availability of fuels and in components for new installations.

How BLP Buys Energy for the Community

Like Grand Haven BLP, many utilities do not produce electricity locally and need to buy power from regional markets. Just like you do not want to put all of your retirement money into a single stock, these utilities follow the practice of diversifying their power supply portfolios to stabilize costs.

“We avoid market speculation by diversifying our power supply to minimize risks to our customers,” said Erik Booth, BLP’s operations and power supply manager. “We continuously evaluate our future power supply mix and we use “hedges” to progressively plan for future years for both energy and capacity.”

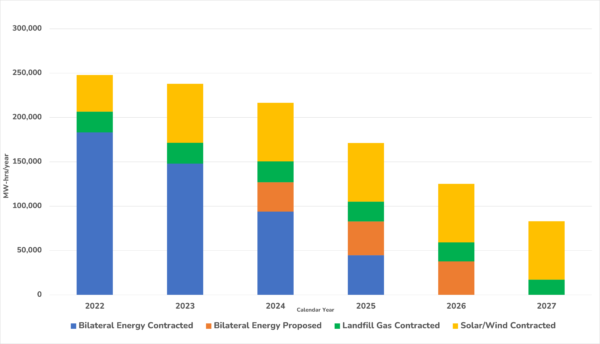

Our community uses approximately 300,000 MWh/year. The BLP has signed contracts for longer-term power purchase agreements for renewables including wind and solar (shown in yellow on the chart below) and landfill gas (green) many years in advance. The energy in blue represents agreements contracted prior to 2022 and orange represents purchases that were made this past spring. Hedging the bulk of our power supply needs a few years in advance is important to reducing the risk of having to purchase large amounts of energy in short-term markets.

Global Markets Have Local Impact

Even with a hedged purchasing strategy, global markets can still affect cost and forecasting for electric utilities like the BLP.

“The energy markets are currently in a period of flux caused by both national and international events, and while our hedging practices minimize the impact, these market conditions still have some effect,” said Booth.

Natural gas prices have been particularly volatile in 2022 due to reasons both foreign and domestic. As Europe is reeling from the impact of sanctions, pipeline closures and uncertainty in the midst of the Russian Invasion of Ukraine, imports from the United States to Europe have increased dramatically. EU energy regulators are even restarting or delaying planned retirements of coal and nuclear plants because of the high costs. Energy Wire, an energy trade publication, reported in July that “exports are up as the [US] tries to ship more liquefied natural gas to allied countries in Europe while a heat wave boosted demand for gas to generate electricity domestically.” Domestically, energy demand in the United States is faced with natural gas storage levels much lower than historical averages while also contending with a generating fleet that is increasingly more dependent on natural gas as baseload coal-fired power plants continue to be retired.

With the EU willing to pay much more for natural gas, US suppliers have been exporting more, which is increasing the cost of natural gas to US power producers.

“As we’re going to the market for the remainder of our balancing energy in 2023, we’re seeing higher prices,” said Booth. “Fortunately, we secured lower rates for the bulk of our energy needs in 2022 and 2023 prior to these increases, which will reduce but not completely eliminate the impact on rates.”

Supply Chain Restrictions

Many of Michigan’s power supply developments have recently focused on solar. Global supply chain disruptions are delaying even those projects that were already approved and in construction.

The Solar Energy Industries Association recently cut new solar development forecasts for 2022 and 2023 by 46%. In March, PV Magazine reported that a combination of factors including human rights investigations in Southeast Asia, section 201 tariffs, and general pandemic-related disruptions was to blame.

MPPA recently purchased two large-scale solar projects in Calhoun County. Both were expected to go into commercial operation by the end of 2022. However, with the recent developments outlined previously, the costs have increased and the delivery date for commercial operation is now expected to be in early 2023 if the project is able to procure the solar panels.

“The solar investments made by the BLP represent a clear illustration of the need to diversify our power supply portfolio,” commented Booth. “The BLP remains committed to expanding our renewables investments, which has increased dramatically from 8% up to 22% over the last five years and includes a diversity of projects. Had we gone all-in on any one of these projects, we would have increased our risk and exposure to more volatile impacts from the global supply chain and short-term energy markets to compensate for the delays in launch.”

Learn more about the BLP’s power supply planning at ghblp.org.