In evaluating the effectiveness of the BLP, the greater Grand Haven community has consistently voiced a high priority on three main factors:

- Reliability – can I rely on my power provider for my electricity, a basic essential need?

- Affordability – are my rates reasonable and competitive?

- Sustainability – is the BLP consistently managing its operations in an environmentally responsible manner, with an eye toward its future needs?

The BLP has a solid track record with all three, stemming from the Board’s strategic planning and forward-thinking approach to operating the utility and properly managing its financial resources.

Operating the BLP Like a Business

In alignment with the requirements of the City Charter, the BLP conducts its operations using “best practices.” This means that the utility follows sound business principles in guiding its operations, making necessary capital investments in electrical infrastructure, and following a prudent financial plan. In running the utility this way, we create significant value for the community.

The energy markets are rapidly evolving, generating resources are shifting drastically, and market price volatility has reached levels not experienced before. By developing a diversified power supply portfolio, the BLP has adapted, significantly reducing its costs, and improving our competitiveness. While electric utility customers across the nation have seen their rates soar recently, the BLP has been able to hold fixed base rates steady and minimize the impact of cost increases to our customers. This keeps money in your pocket, helps commercial customers reinvest in their own businesses, and helps our industrial customers focus on maintaining their competitiveness which improves our local economy.

Taking Financial Responsibility Seriously

As with our intentional approach to power supply planning, the BLP has implemented similar financial planning tools in its management of the organization’s finances. One example would be the proactive management of the utility worker’s pension plan. Based on the most recent actuarial report, the BLP pension program is approximately 95% funded. This is in stark contrast to many government organizations that are struggling with these unfunded pension and retiree health liabilities. According to the Pew Charitable Trusts, the state of Michigan had a funding ratio of 60.4% which was the 15th lowest level in the country in 2020. These unfunded liabilities create a huge burden, which is why the BLP took necessary measures in 2017 to close the pension program and set a course to properly fund these liabilities. What this means for our customers is that they are not saddled with unfunded liabilities from past inaction well into the future.

Providing Value and Increasing Returns to the Community

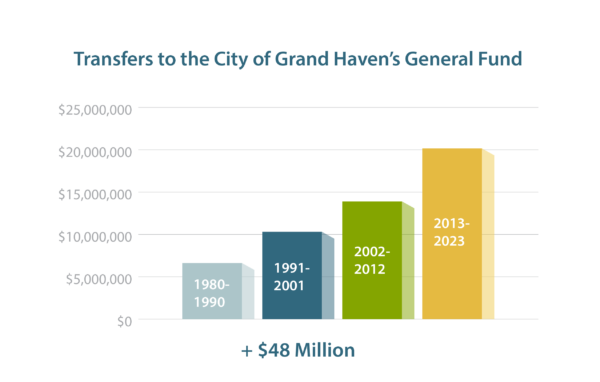

Municipal electric utilities like the BLP not only provide lower rates for their customers but also provide tremendous value to the communities that own them by supplying a return on their investment to the City’s General Fund. Since implementing its current financial plan

eight years ago, the BLP has transferred over $14.8 million to the city’s general fund, with over $48.4 million in total transfers over the last four decades.

A Scorecard of Financial Management

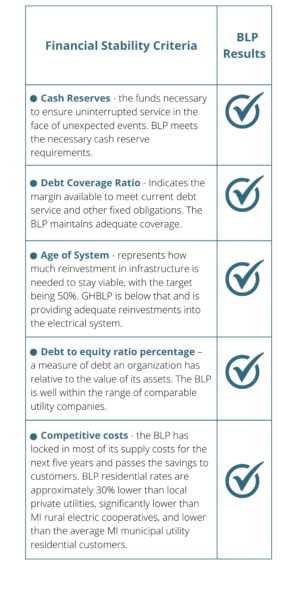

In a further measure to ensure fiscal sustainability and stability, the BLP partners with Utility Financial Solutions (UFS), experts in financial planning and strategy for utilities across the country.

“From a utilities perspective, the Grand Haven BLP is very financially stable,” commented UFS President and Founder, Mark Beauchamp. Supporting this perspective, UFS has established several industry benchmarks. Beauchamp points to five standards commonly used to gauge the financial viability of a utility organization:

Regarding the final standard from the table above, the BLP exercises a strategy of wholesale market diversification and forward incremental purchases to avoid over-committing to one type of power purchase at any given time, while simultaneously increasing our proportion of renewable energy within that portfolio. In doing this, the utility addresses price volatility in the wholesale market and avoids over-dependency on any one resource purchase. These efforts keep our rates consistent and competitive.

To sum up, when looking at the financial management of the BLP, we are adhering to the planning measures put in place years ago, when we changed our power supply portfolio. The ability to return almost $2 million/year to the city’s general fund, the steadiness of the operating revenue and utility rates, the conscientious administration of the Board’s pension fund, the increasing investments in renewable energy, and the implementation of strategic guidance from financial experts clearly show that the Grand Haven community’s energy needs are being managed to provide our community with a financially stable electric utility future.